What Is Trading?

Trading is the buying and selling of financial assets such as stocks, forex, metals, etc. The term “trading” refers to this activity which is performed by someone or something called a trader. A trader is anyone or anything that is buying or selling a financial asset. Often, when someone uses the word “trader,” they are […]

How to Use Moving Averages for Trading

Moving averages (MAs), are one of the most well-known yet unused technical indicators. They are generally used to smooth out price data and show the average price, but there are several ways that they can be used for trading. Moving averages allow traders to employ many strategies, some of which are well-known and some of […]

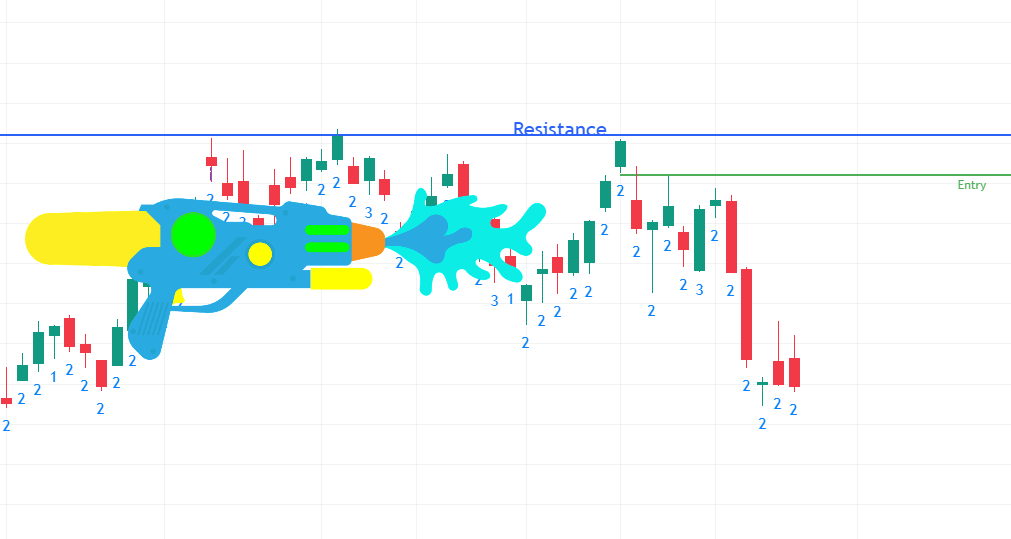

What Is the Pivot Machine Gun – STRAT Trading

The Pivot Machine Gun (PMG), is a STRAT method strategy that is not very well known in the technical analysis world but also employs the chance of price rapidly increasing or decreasing in a short amount of time to profit. It works just like the other STRAT combos and it employs time frame continuity. STRAT […]

How to Day Trade With the STRAT Method

Those who day trade often follow a well-planned and established strategy, as well as a ruleset. These strategies come in different forms like scalping, pullback trading, breakout trading, and in this case, the STRAT method. Claim Your FREE STRAT Combos Cheat Sheet What Is the STRAT Method? The STRAT method is possibly one of the […]

What Is a Stop-Loss? – Definitions and Examples

A stop-loss is a certain action that can be performed at a certain price to limit loss. It usually takes form as a selling action once an asset reaches a specific price. It not only helps traders stay disciplined but also ensures that traders follow part of a certain ruleset which may significantly prevent loss. Having […]

What Is Time Frame Continuity? – STRAT Trading

When looking at the time frames of a chart, time frame continuity basically means that the more time frames that are moving in the same direction that you are trading in, the higher chance of the trade working out. Still, there is always risk and this doesn’t guarantee a trade working out. Time frame continuity […]

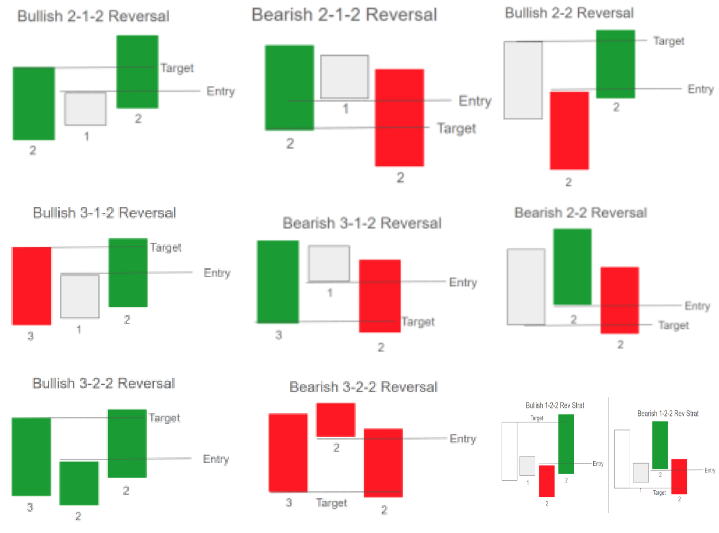

STRAT Reversals – Explanations and Examples

STRAT Reversals are combos that signal a possible reversal of the trend. There are many reversal combos, some of which are easier to scan for than others because they are more distinct. Reversal combos may even start a continuation combo because of the fact that they signal a possible reversal of the trend. The STRAT […]

How to Trade the Pipe Tops and Bottoms Chart Pattern

The Pipe Tops and Bottoms pattern uses individual candlesticks to determine possible trading opportunities, which can occur on both daily and weekly charts. Yet, Pipe patterns on a weekly chart generally perform better than those on a daily chart. It may seem similar to a Horn pattern as traders may execute trades based on levels […]

3 Popular Chart Patterns for Scalping

While there are many possible chart patterns and concepts that scalpers use to trade, these simple yet effective patterns that may be a scalper’s dream. Scalping is a certain trading style where traders specialize in making quick trades off small price changes. It uses the concept of support and resistance heavily and can incorporate indicators and chart […]

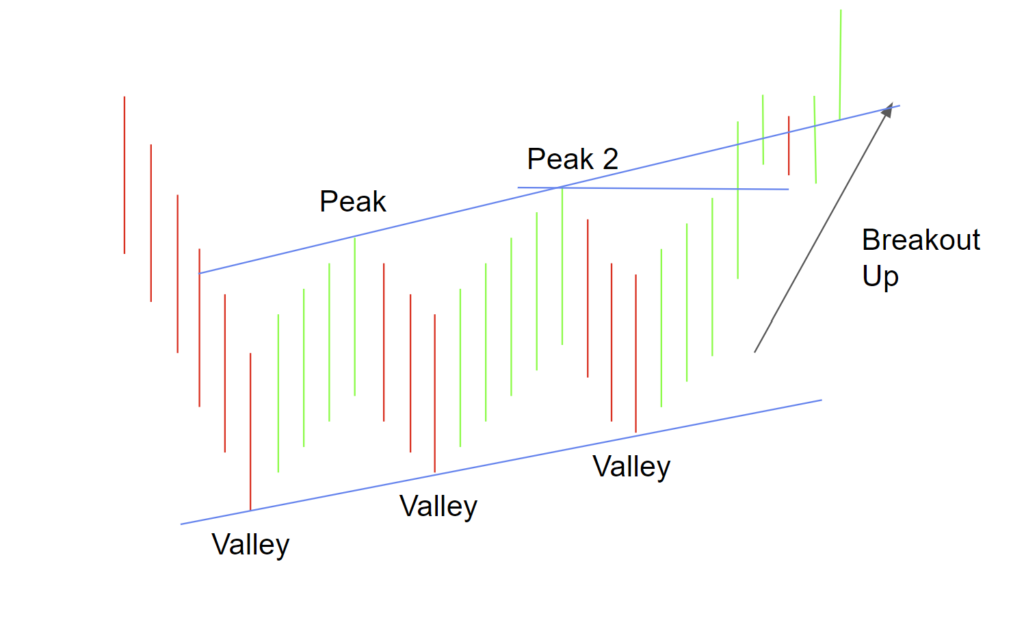

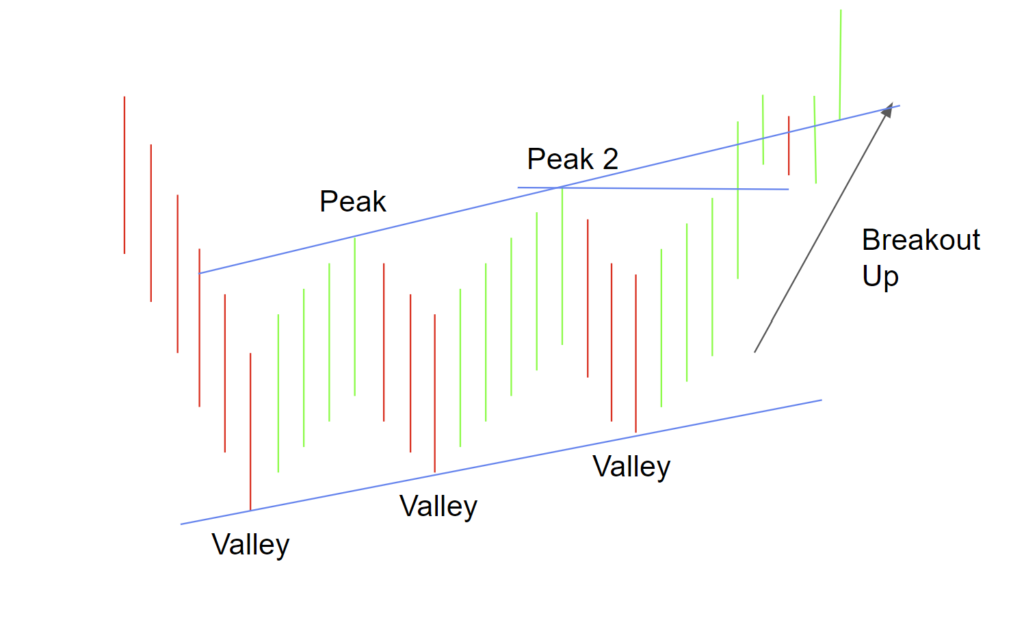

How to Trade the Three Rising Valleys Chart Pattern

Some traders may consider this pattern to be their favorite trend change pattern. Like the Three Falling Peaks pattern, the Three Rising Valleys (3RV) pattern is a breakout pattern. It is often seen in the stock market due to its simple identification, where the main part of the pattern is three valleys, each consecutive valley […]