Trading is the buying and selling of financial assets such as stocks, forex, metals, etc.

The term “trading” refers to this activity which is performed by someone or something called a trader.

A trader is anyone or anything that is buying or selling a financial asset. Often, when someone uses the word “trader,” they are referring to the regular person performing this activity. These traders usually use their own capital or the capital of a company to trade with.

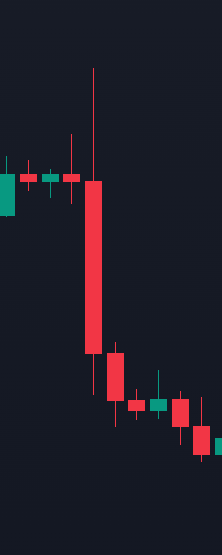

So when a trader buys an asset like a stock or a currency pair, they generally have the option to choose how much of that asset they want to purchase. This comes down to many factors like account capital and a trading strategy. Buying pushes the price of an asset up.

When a trader sells an asset they generally have the option to get rid of a certain amount of it. Selling drives down the price.

Selling can also refer to shorting, which is when a trader bets against the price, so the trader makes money if price falls.

Many good traders follows certain rules in which they call a trading strategy. This trading strategy is a special criteria on how a trader should trade. There are many aspects to a trading strategy, one of which may specify whether the trader trades or invests.

Trading VS Investing

There are different types of buying and selling and people use them in different ways. Trading is a big umbrella term.

Investing

The word investing is usually used when referring to long term holding of an asset. Investing often refers to building money for a certain retirement or funding goal. So investing can be a type of trading, because to place a trade is to buy or sell a certain asset.

Trading

Trading can also be long term, but usually is referring to shorter term buying and selling. There are some trading types that people like to label themselves as according to how frequently they trade.

The main ones that this article will cover are long term trading, swing trading, day trading, and scalping.

Long Term Trading

The phrase long term trading is generally used for holding trades 6 months or longer. It’s sometimes used to refer to investing.

Swing Trading

Swing trading is usually holding a trade any time longer than a day to 6 months. So a swing trade can be a week long trade, or a 2 day long trade, or a 2 month long trade.

Day Trading

Day trading, sometimes referred to as intraday trading, is holding a trade for less than a day. So it can be 2 hours, 2 minutes, or 10 hours.

Scalping

Scalping is a certain specific way to day trade, which is when traders take very short trades to capture a quick price movement. It’s a very fast paced way to trade.

Many trading strategies focus on target prices instead of how long to hold it for. So whether it takes a day for price to hit the target or a week for price to hit the target, the trader will stay in the trade as long as their rules are met. So ultimately, it’s important to understand the different types of trading but even more important to build a strategy that aligns with the trader’s lifestyle and trading objectives.

Asset Types

We’ve been talking about assets and there are different types of assets in trading, but what is an asset?

Basically, an asset is some market or some financial instrument that is able to be traded. Popular trading assets include:

- Forex Pairs

- Stocks

- Metals

Overall, a strategy should be created around trading an asset or multiple assets with certain rules. It’s essential to backtest any trading strategy a trader creates and understand the risks associated with trading. If you need help understanding these risks, contact a licensed financial advisor.