The Horn Tops and Bottoms pattern is particularly interesting because while utilizing the same concept of support and resistance, it goes in-depth into the individual candlesticks of the pattern. The Horn pattern also utilizes the concept of a breakout to catch a reversal.

The Horn pattern is a reversal pattern that has two types: The Horn Tops, and the Horn Bottoms. It is best seen on a weekly chart and usually, tall Horn patterns perform better than short Horn patterns.

This pattern is not to be confused with the Double Top and Bottoms pattern, as this pattern uses focuses more on individual candlesticks and a different trading strategy.

Quick Notes:

- The Horn pattern is a reversal pattern.

- The top portion of a Horn Tops pattern is called the “Head,” with the two “Horns” as the two abnormally high candlesticks.

- The bottom portion of a Horn Bottoms pattern also has two abnormally low candlesticks.

- On a Horn Tops pattern, a may reversal be signaled when a candle closes below the lowest low of the three candlesticks that make up the Head.

- On a Horn Bottoms pattern, a may reversal be signaled when a candle closes above the highest high of the three candlesticks, the two Horns, and the candle in the middle.

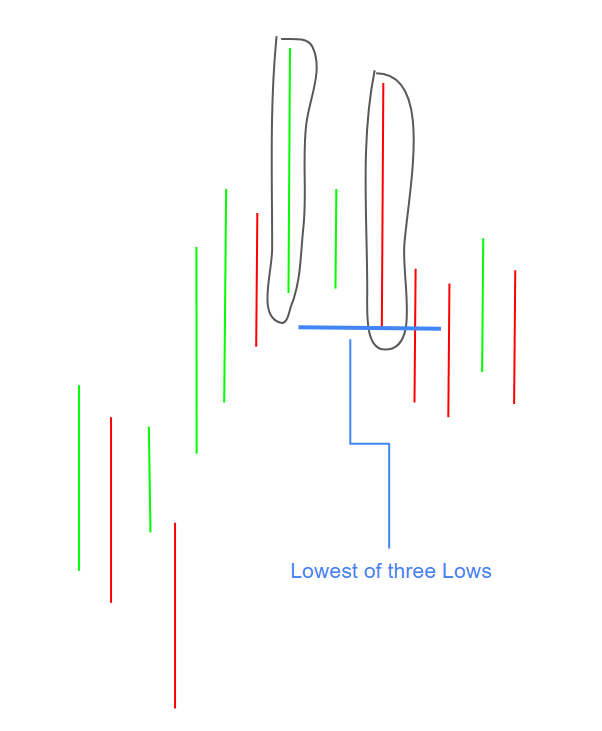

The Horn Tops Chart Pattern

The Horn Tops pattern forms from an uptrend, where the top portion of the pattern creates two abnormal candlesticks, meaning that they are higher than normal but usually have highs that are roughly in the same area. There is also a smaller candlestick in the middle of the two.

These two high candlesticks are called “horns” as some technical analysts like to visualize the pattern as a bull, with the smaller candlestick in the middle as the head.

How to Trade the Horn Tops Pattern

The three candlesticks that make up the head of the pattern create three lows. When trading the Horn Tops pattern, traders look for the lowest of the three lows.

This head, the horn pattern generally is more significant after a long uptrend.

In this case, the candle to the right (the right horn), has the lowest point. This low creates a significant level of support.

Traders may then be on alert for a breakout and may be waiting for confirmation because this support level acts as a reversal point.

If a candle shows confirmation of a breakout to the trader, it may be a sign of a reversal in the trend, and an opportunity to short or sell.

Confirmation in this chart pattern usually takes place when a candle closes below the lowest of the three lows.

Volume can also be used as a sort of second confirmation, as a pattern with increased volume on the breakout may better the chances of a price target being reached and more reliable signals.

Technical indicators like the RSI or the MACD may also be used as trade signals.

Learn more on confirmation here.

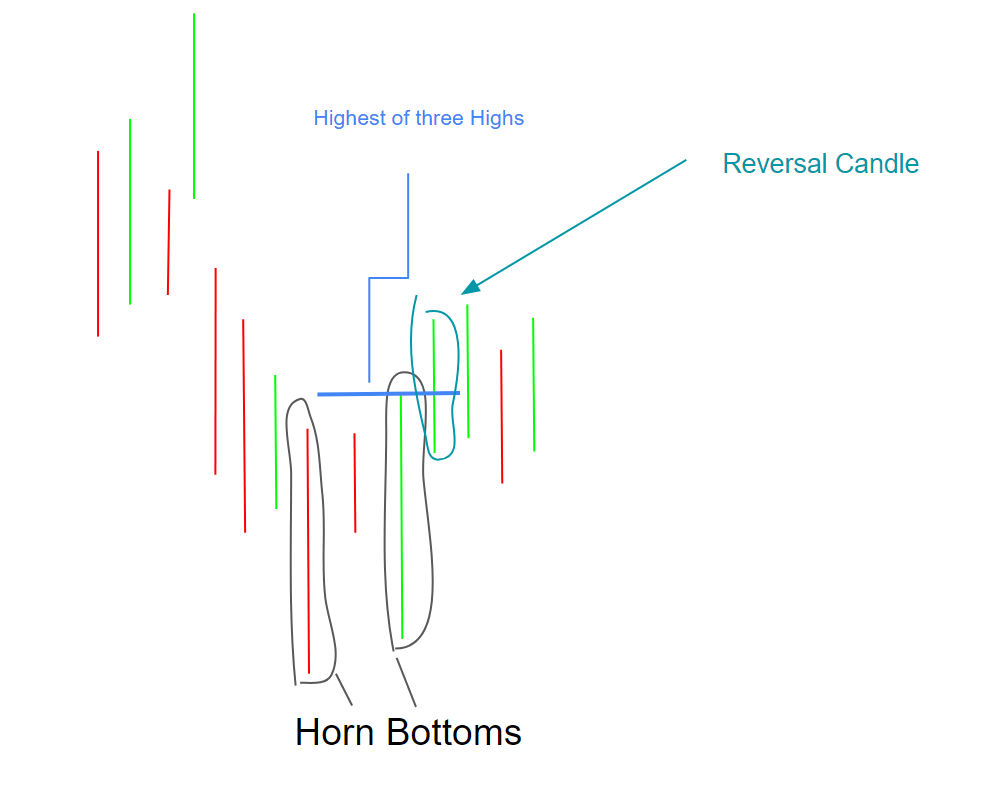

The Horn Bottoms Chart Pattern

The Horn Bottoms pattern is simply the opposite, where it starts with a downtrend, and creates two abnormally low candlesticks. It may be categorized as an upside-down head of a bull.

Just like the Horn Tops pattern, it is a reversal pattern.

How to Trade the Horn Bottoms Pattern

Traders may look for the highest of the three candlesticks that make up the bottom of the pattern, as the highest high creates a level of resistance.

If a candlestick closes above this level of resistance, traders may buy the breakout.

It is advised that traders should wait for confirmation on the breakout in both the Horn Tops and Bottoms patterns in an attempt to minimize risk. Although, risk can never be removed completely, so trade at your own risk.

Timeframe Strategy

This is one strategy that traders sometimes use while trading a horn pattern. It involves the analysis of two different time frames, long and one short, and may be seen used for other chart patterns.

First identify two time frames, one long and one short.

If the long-term trend direction and the short-term trend direction are the same, then it may increase confidence in a trade because of time frame continuity.

If the long-term trend direction and the short-term trend direction are not the same, then it may have a higher chance of generating a loss.

This strategy doesn’t always work out perfectly, but time frame continuity is a real concept that traders use for stocks.

The Stop-Loss

A stop-loss is a certain action that can be performed at a certain price to limit loss. It usually takes the form of a selling action once an asset reaches a specific price.

It not only helps traders stay disciplined but also ensures that traders follow part of a certain ruleset which may significantly prevent loss. Having a ruleset and following it is essential to managing risk.

Also Read – What Is a Stop-Loss? – Definitions and Examples

Many traders place their stop-loss above the Horn Tops or below the Horn Bottoms. Generally, they choose the longest candle and use it as almost a level of support or resistance at which to place their stop-loss with a buffer of 5-10pips.

While this may work and having a stop-loss usually is better than not having one, many traders may get stopped out prematurely, often if the price evolves past a Horn pattern.

To avoid this, traders may use an indicator called the Average True Range (ATR). Traders may avoid tight stop-loss placement with the help of the average true range indicator.

The ATR measures volatility and traders reading it can combine it with the placement of a stop-loss to attempt and place a better stop-loss than by just using a concept like support or resistance.

Keep in mind though that because indicators are naturally trailing, you are looking into past data.

The strategy involves adding or subtracting the value of the average true range indicator to or from the value of where you want to place that stop-loss level.

Very nicely explained

Thank you! I like your website too!