What Is Support and Resistance? A Complete Guide

Support and resistance levels are points of supply or demand of the stock. The concept of support and resistance is one of the most discussed topics in technical analysis and the stock market because it leads to so many other topics like chart patterns, indicators, Elliott waves, and more. Quick Notes: What Is Support and […]

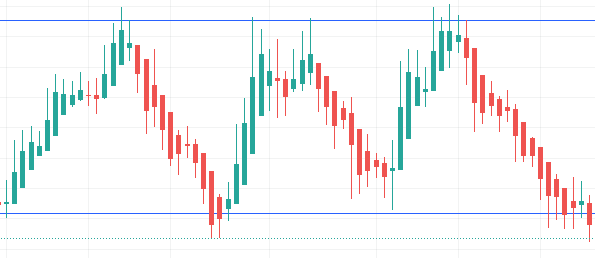

How to Read and Understand Candlesticks

Candlesticks are a Japanese invention thought to be developed by Munehisa Homma. Candles are used in technical analysis to identify trends and patterns in a company’s stock in more detail than just a regular line chart. They represent the emotions of traders and a more detailed look at a stock’s price. For most charts, the […]

How to Know What Type of Investor You Are

TYPES OF INVESTORS: Growth Investor Investors that buy into companies that are growing quicker than the stock market is growing, AKA, thriving. Also Read – How To Predict Stock Movement: Support and Resistance Value Investor Value Investors buy into companies when the stock price of said company is lower than what they think the value […]

How To Predict Stock Movement: Support and Resistance

How Do You Predict the Future of the Stock Market? Is accurately predicting the future of the stock market 100% of the time a possibility? Well no, it’s not. Still, certain strategies can increase the likelihood of an investor’s success. Stock movement is constantly trying to be predicted by investors, traders, and software. There are […]

The Bollinger Bands® Indicator Makes Predicting the Stock Market Easy

Bollinger Bands This powerful indicator may be used by traders to identify overbought or oversold signals, and can also be used to measure the volatility of the stock. It is used usually by technical analysts, those who practice technical analysis. Obviously, “Easy” in the title does not mean that trades will always work out 100% […]

How to Use the Most Powerful Stock Market Indicator (MACD)

Introduction to the MACD Now, “best” or “most powerful” is definitely subjective and this indicator does not always guarantee success. Yet, it is one of the most popular technical analysis indicators in the stock market world. The indicator is called the Moving Average Convergence Divergence, or MACD. Quick Notes: The MACD It may look kind […]

How to Trade Broadening Bottoms and Tops

A broadening bottom is bullish on the breakout and a broadening top is bearish on the breakout. This pattern is used by technical analysts, those who study technical analysis. Quick Notes: Also Read – How to Read and Understand Candlesticks The overall broadening pattern is bearish if it breaks below the bottom trend line or the […]