Investors and traders sometimes use what’s called a Price-to-Earnings (P/E) ratio to value a company. It is generally attributed to a strategy of fundamental analysis, which as opposed to technical analysis, is the study of a company’s and its stock’s intrinsic value. This calculation is able to explain how much a company is worth based on its earnings and stock price. Based on its past or future earnings, the P/E ratio highlights what the market or traders are willing to pay today for the company’s stock.

Quick Notes:

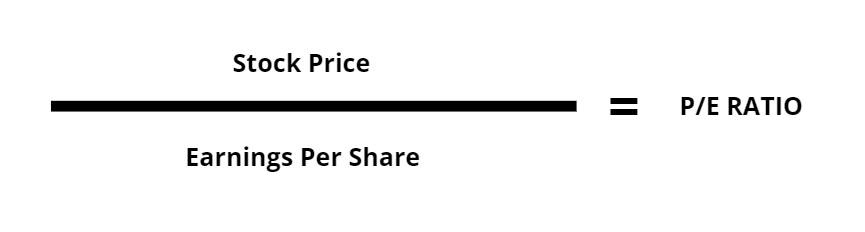

- P/E Ratio Calculation: Stock Price/Earnings Per Share (EPS).

- EPS Calculation: Earnings/Shares

- The Price-to-Earnings (P/E) ratio tells investors how to value a company and how much the market is paying for that company.

- Two Types of P/E Ratio: Trailing (past earnings) and Forward (expected earnings)

- Simply calculate the P/E Ratio using the P/E Ratio Calculator

How to Calculate the P/E Ratio

P/E Ratio Calculation: The stock’s price divided by the company’s earnings per share.

By taking the stock’s price and dividing it by the company’s earnings per share, a P/E ratio is given which may be relative to the stock and the type of company. To understand what the ratio number means, let’s look at an example:

Car Manufacturers P/E Ratio Example

Here, we have company A and company B. Company A profits $500,000 per year with a stock price of $500 and a volume of 100,000 shares. Volume is basically the total amount of shares being traded in the stock. Company A is in a city with only 10,000 people.

The other company, company B profits only 100,000 dollars per year, has a stock price of $100, and a volume of 50,000 shares. Yet, company B is in a city with 50,000 people. Now let’s move on to the calculations:

Also Read – How to Use Stock Splits to Your Advantage

P/E Ratio Calculations:

To calculate the earnings per share, or for short, EPS, take the earnings AKA the company’s profits, and divide it by the total amount of shares traded. In this example, company A has an EPS of 5 dollars. Then, to calculate the P/E Ratio, take the price per share and divide it by the EPS. So 500 divided by 5 turns out to be 100, which means that the stock has a P/E Ratio of 100.

For company B, divide the $100,000 in earnings by the 50,000 shares which come out to be a 2 dollar EPS. Then take the 100-dollar share price and divide it by the EPS, which is 2 dollars. This comes out to a P/E Ratio of 50.

How Do We Interpret The P/E Ratio?

So how do we interpret this? Although company A’s stock is higher, meaning more money is invested into it, company B has a lower P/E Ratio AND is in a city with more people. So, company B might be the better investment because it is valued lower and has greater growth potential than company A.

“In short, the P/E ratio shows what the market is willing to pay today for a stock based on its past or future earnings. A high P/E could mean that a stock’s price is high relative to earnings and possibly overvalued. Conversely, a low P/E might indicate that the current stock price is low relative to earnings.” – Investopedia

The Two Types of P/E Ratios

Trailing P/E: A trailing P/E represents a company’s value based on its past earnings or those that have already been logged in the last 12 months. A trailing P/E also represents how much an investor is paying per dollar of a company’s earnings. So if the trailing P/E is 10, an investor is willing to pay 10 times their share of a company’s profit.

Forward P/E: A forward P/E ratio represents a company’s value based on its expected earnings, or how much profit it is predicted to make in the next 12 months.

Sometimes, by comparing the forward P/E ratio to the trailing P/E ratio, that calculation can be used to determine stock health. Still, it may not be accurate or may mean something else. So use other analysis and tools.

Risks of both: The problem with a trailing P/E is that it is accounting for a company’s past earnings and does not account for future products or services that that company might produce. For example, let’s say a computer parts company has a trailing P/E of 10 but is expected to launch a new motherboard in the next 6 months which will totally change the game in computer technology.

This is where a trailing P/E will still say the same, in this case, 10, while a forward P/E would account for the company’s future, expected earnings. The problem with a forward P/E ratio is that no one can accurately predict the future and be sure of it.

It is also wise to be careful of solely relying on the P/E ratio to trade that company. For example, small companies generally have lower P/E ratios than large companies. This is one of the many reasons why it is foolish to rely on just one indication for trading. Use all the tools available to trade, and always understand the risk.

View an online P/E Ratio Calculator: https://successacademycourses.com/price-to-earnings-calculator/