Stock splits are greatly talked about in the stock market community as they can be a powerful catalyst for traders looking to profit. Before understanding how to trade stock splits, let’s first understand the different types of stock splits:

Conventional Stock Split

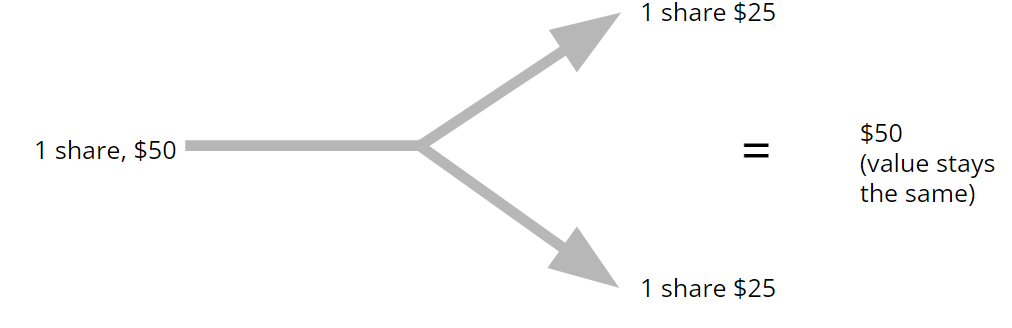

A conventional stock split is when the company creates more shares by dividing its current shares into more shares, thus decreasing the price per share. Because the number of shares increases, the price decreases.

Let’s say that the investor started out at 1 share of 50 dollars. A conventional stock split, in this case, 2:1 would increase the number of shares the investor holds to 2, but decrease the price of each to 25 dollars. 25+25 is still 50 and the value of the investment overall stays the same.

Also Read – How Much Money Do I Need to Trade Stocks?

Why Would a Company Perform a Conventional Stock Split?

A company usually performs a conventional stock split when the cost to buy a share is high. This cheaper value gives an incentive to traders and investors to buy more shares because they are now more affordable.

Reverse Stock Split

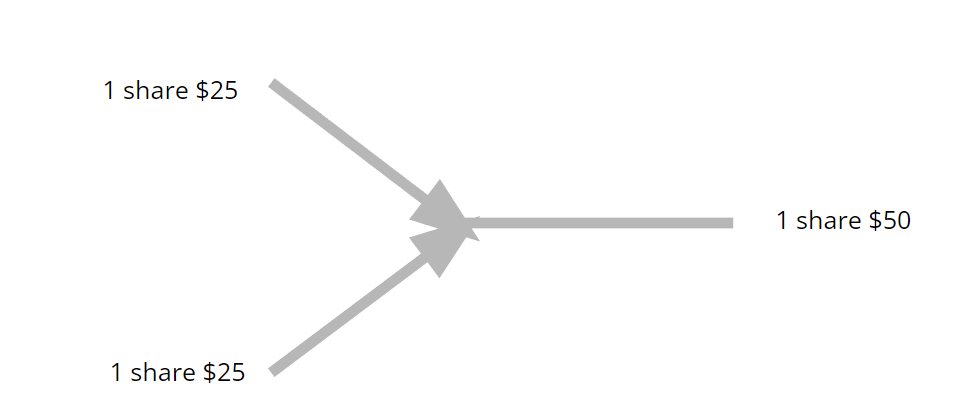

A reverse stock split is when the company decreases the number of shares and increases the price of a share. So, in a reverse stock split, let’s say that the investor initially had 40 shares of the stock, and now only 10, the company performed a 1:4 reverse stock split. This, however, does not change the value of the investment, it only increases the price of one share and decreases the number of shares.

In the image above, let’s say an investor started at 2 shares of 25 dollars. In this case, a reverse stock split, a 1:2 stock reverse split would create 1 share of 50 dollars. The OVERALL VALUE does not change as the price of one share increases.

Why Would a Company Perform a Reverse Stock Split?

A company may perform a reverse stock split when say, the company price is too low that it may risk being delisted from an exchange, or the company wants a better outlook on its stock.

Want to learn more about investing, trading, and money? Head over to our courses here:

How to Use Stock Splits to Your Advantage

A company usually performs a conventional stock split when the cost to buy a share is high. The board of directors can choose to split the stock at any ratio.

This cheaper value gives an incentive to traders and investors to buy more shares because they are now more affordable.

So, one strategy may be to buy before a stock split, and hope the stock goes up. Another strategy may be to sell during or after the stock split if the trader already is in the stock.

In a reverse stock split, a stock may decrease after for the reason of investors losing faith in the company. This may give the opportunity for the trader to short, sell, or buy the dip.

You can find a NASDAQ Stock Splits Calendar here.

Why Would a Company Not Want to Split Its Stock?

We’ve talked about the benefits for both the company and the investor, but what are some negatives, or challenges, with a stock split?

Laws

There are regulatory laws that associate with the process of a stock split. These legal barriers are to meet companies that perform and want to perform a split. Regulations include:

- Corporations must notify the SEC before the stock split, with a minimum of 10 days, while listing the shareholders who are eligible to participate and the prospective date of the actual stock split.

- They are not taxable events

- Companies must register and split in accordance with their stock exchange

Expenses

According to Investopedia, “The company wanting to split their stock must pay a great deal to have no movement in its over market capitalization value.”

Exclusivity

A company may not perform a stock split because of the type of crowd one attracts.

For example, if a company’s price is so high, possibly in the hundreds of thousands, that stock may only be able to be bought by investors with large capital and not traders. This may be the intention of the company, to keep the stock exclusive.

Risks

Like we talked about before, delisting is a risk which can not only negatively affect the type of trading a stock receives, but also affect the sentiment surrounding that stock. This can be damaging for the company and its investors.

When a company reverse splits, the price of one share increases and the amount of shares the investor owns decreases. A reverse stock split may be done to prevent risks like delisting and/or negative sentiment.

Still, there is a comparison that if a cake tastes horrible, it does not matter if the cake has been cut into 5, 10, 15, 20, etc. pieces, it still tastes bad. This comparison represents an ideology of some investors and traders for stock splits. It doesn’t mean it is true, but it is something important to note.