Albert Einstein is famous for saying, “Compound interest is the eighth wonder of the world. He who understands it earns it… he who doesn’t… pays it.” Dividends are often referred to as a way to make compound interest in the stock market. But what is a dividend?

What Is a Dividend?

A dividend is an amount of money the said company pays you (usually quarterly and per share). It is their way of sending out basically a “thank you” note for holding their stock.

Selling a stock means that you no longer receive dividend payments from them. So if the stock is a defensive stock, (a stock that generally maintains the same price throughout all markets and provides consistent dividends), then selling it at the same price you bought it may not be as smart as holding it and passively reinvesting the dividends. This is passive income.

What Is Passive Income?

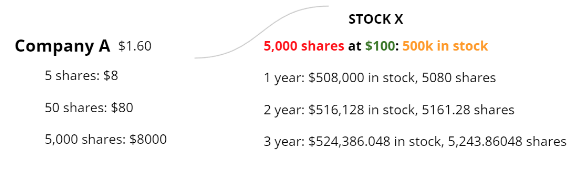

Passive Income: The ability to make money while simultaneously not working. Look at this example:

Also Read – How Much Money Do I Need to Trade Stocks?

Let’s look at Stock X. Stock X is valued at 100 dollars, and this investor has bought 5 thousand shares, which value at 500,000 dollars invested into the stock. Yes, this is a large amount but it is just an example. In this example, the first-year returns 8000 dollars into the stock. An immediate reinvestment of the dividends into the stock will create 80 more shares. Now, this investor has 5080 shares of the stock. In the second year, the amount of money invested into the stock increases to 516 thousand and 128 dollars, which is 5161.28 shares.

In the third year, the amount invested into the stock increased to 524 thousand and 386.048 dollars which is 5243.86048 shares. As you can see, reinvesting dividends, through compounding, can create passive income effectively and all an investor has to do is watch the price of the stock, to make sure it is not getting too low. If held for after 50 years, the amount of money invested into the stock would be over 1 million dollars, assuming all of this is at a dividend of 1.60 dollars.

How Do You Calculate Compounding Interest?

Here you can view a compounding interest calculator.

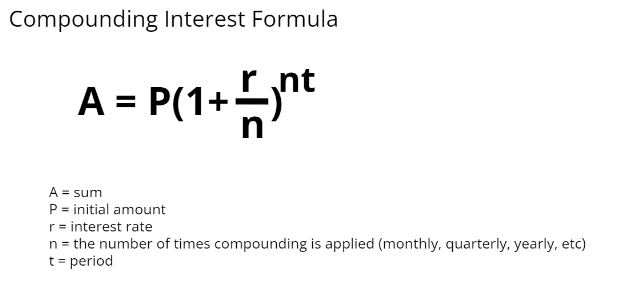

The A is the sum, the end result. The P is the initial amount of money invested, the R is the interest rate or the dividend percentage which is the percentage of the company’s share price that makes up the dividend. The N is the number of times the compounding is applied whether it is monthly, quarterly, or yearly. And the T is the time period in years. The difference between N and T is that the N is the number of times in a year, so weekly would be 52, monthly would be 12, etc.

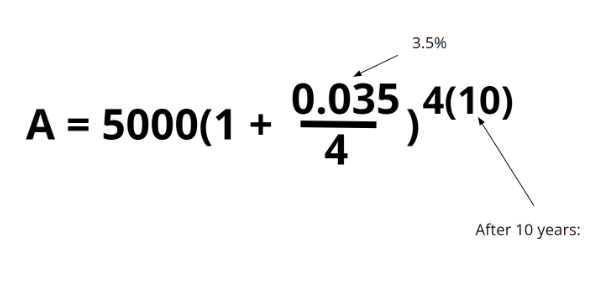

So let’s put 5000 dollars in for the initial amount,

Then put 0.035 for 3.5%, the interest rate.

Then put in 4 for n, the number of times per year, which in this case would be quarterly because there are four quarters in a year.

Then put 10 in for the number of years.

And after 10 years, 5000 dollars compounded quarterly at an interest rate of 3.5% comes out to be 201 thousand, and 750 dollars.