Divergence is a widely discussed topic in the technical analysis world. It can signal potential momentum or potential reversals which is why technical analysts examine this indication extensively.

Quick Notes:

- Four types of divergence: Regular Bullish Divergence, Regular Bearish Divergence, Hidden Bullish Divergence, Hidden Bearish Divergence

- Divergence does not always exist in the chart, but it may be very powerful when it does

- Recognizing divergence is simple when the trader knows what to look for

What is Divergence?

Divergence is simply when price moves in the opposite direction of an indicator. Popular indicators that traders use when identifying and trading divergence include the RSI, MACD, and the CCI.

Divergence can serve as a warning or an indication of potential price movement.

How to Recognize Divergence

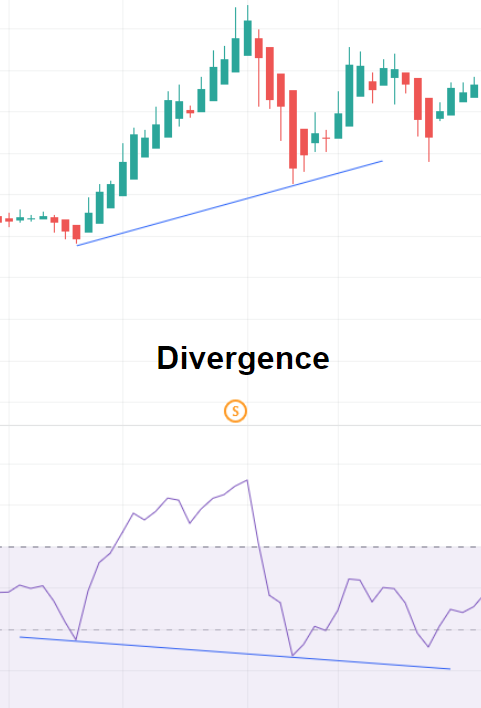

Divergence can be recognized by sight or by computer programs that screen for divergence. To recognize divergence though, look for price that is moving in the opposite direction of the indicator. Here’s an example:

In this chart, we see that price has created a low, then a higher low. The indicator on the other hand, has created a low, and then a lower low.

This divergence resulted in a bullish trend, at least for a little. It is advised to be careful and understand the risks of trading divergence, because it is not always going to move in the anticipated direction, and/or the move may be delayed.

The Four Types of Divergence

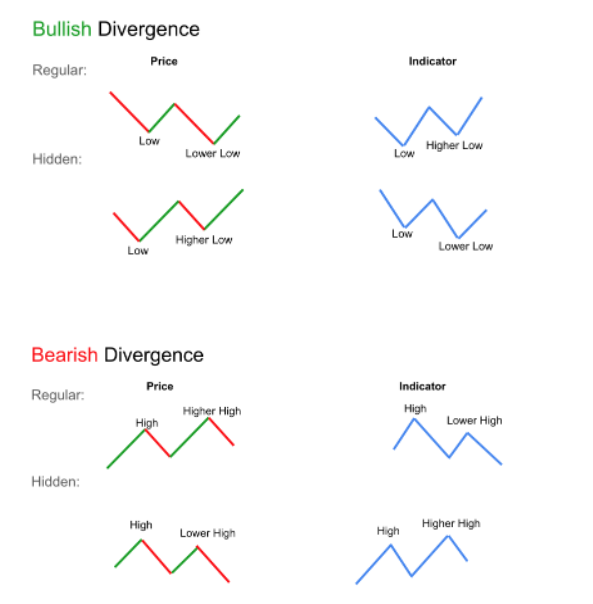

There are four types of divergence which are sometimes also referred to as positive and negative.

This infographic shows two main types, bullish divergence and bearish divergence, and then two types of bullish and bearish, regular and hidden. Let’s look at an example of each of these:

Regular Bullish Divergence

In this case, we see regular bullish divergence. The price formed a low, and then a lower low, and the indicator formed a low, then a higher low.

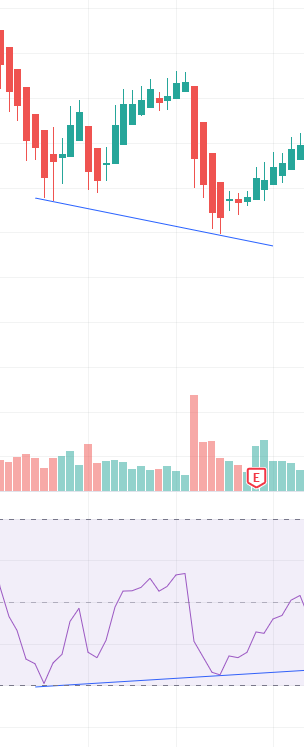

Regular Bearish Divergence

This bearish divergence is regular when price forms a high, and then a higher high, and the indicator also creates a high, and then a lower high. The anticipated result is bearish movement.

Hidden Bullish Divergence

This divergence is when price creates a low, and then a higher low, while the indicator creates a low, and then a lower low. Its anticipated result is bullish movement.

Hidden Bearish Divergence

In this example, we see hidden bearish divergence. The price has created a high, then a lower high, and the indicator created a high, then a higher high.

How to Trade Divergence

Traders trade divergence occurrences by predicting price movement based on what type of divergence it is. So, if the divergence is bullish, the trader may buy and if the divergence is bearish, the trader may sell or short.

Confirmation

Divergence can also be used to confirm a trend or confirm a move. If the trend is bullish and there is bullish divergence, it may be reassuring to the investor or trader that the trend may continue.

Divergence can also be used to warn of a discontinuation of a trend, as if the trend is bullish and there is bearish divergence, the trader may decide their next move based on that divergence, as it may warn of a discontinuation of the trend.

Risks of Using Divergence

Divergence in the stock market, and in any chart, is not always going to work out. A bullish divergence may turn bearish and a bearish divergence may turn bullish.

An occurrence of divergence will also not exist in every trend continuation or reversal so another form of risk control and/or analysis should be known and used when trading.

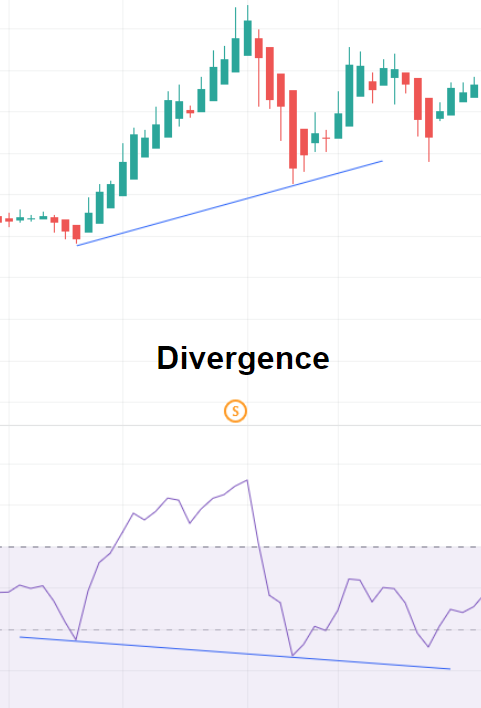

More Examples of Divergence

This example shows that price created a high, then a higher high, and that the indicator formed a high, and then a lower high. This shows regular bearish divergence.